Businesses Combatting Food Waste: Mapping the Global Innovation Landscape

Food waste has evolved from a mere inefficiency to a major global issue with environmental, social, and economic implications.

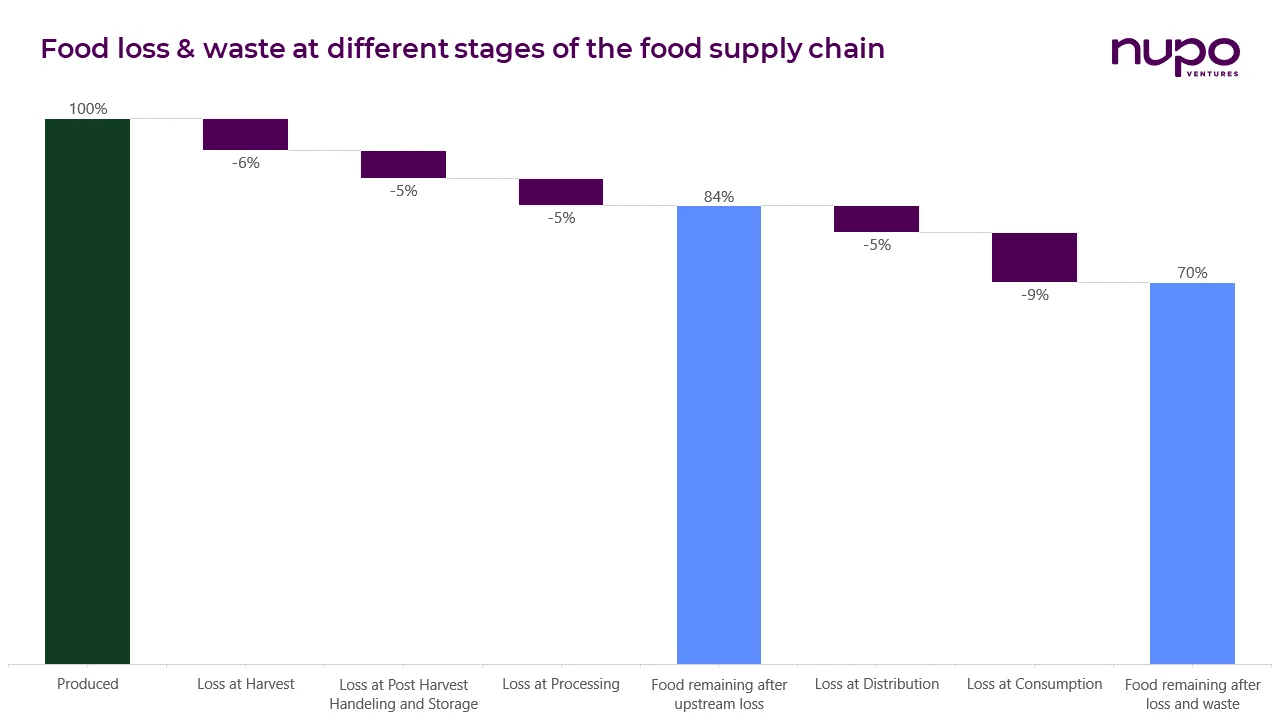

It arises at every supply chain stage, driven by overproduction, strict aesthetic standards, poor distribution, and consumer behavior. This waste not only emits significant amounts of methane (the decomposition of discarded organic matter releases methane contributing about 8% of total anthropogenic GHG emissions) but also represents a wasteful use of resources used in food production. Furthermore, the resources invested in growing, harvesting, transporting, and processing discarded food are squandered, escalating the strain on ecosystems. Socially, it highlights the stark contrast between widespread hunger and food abundance. Economically, it inflicts substantial losses on producers, retailers, and consumers alike.

However, there's hope. With dedicated efforts, innovative approaches, and global cooperation, we can manage supply chains more efficiently, increase consumer awareness, and creatively repurpose excess food, addressing this critical issue.

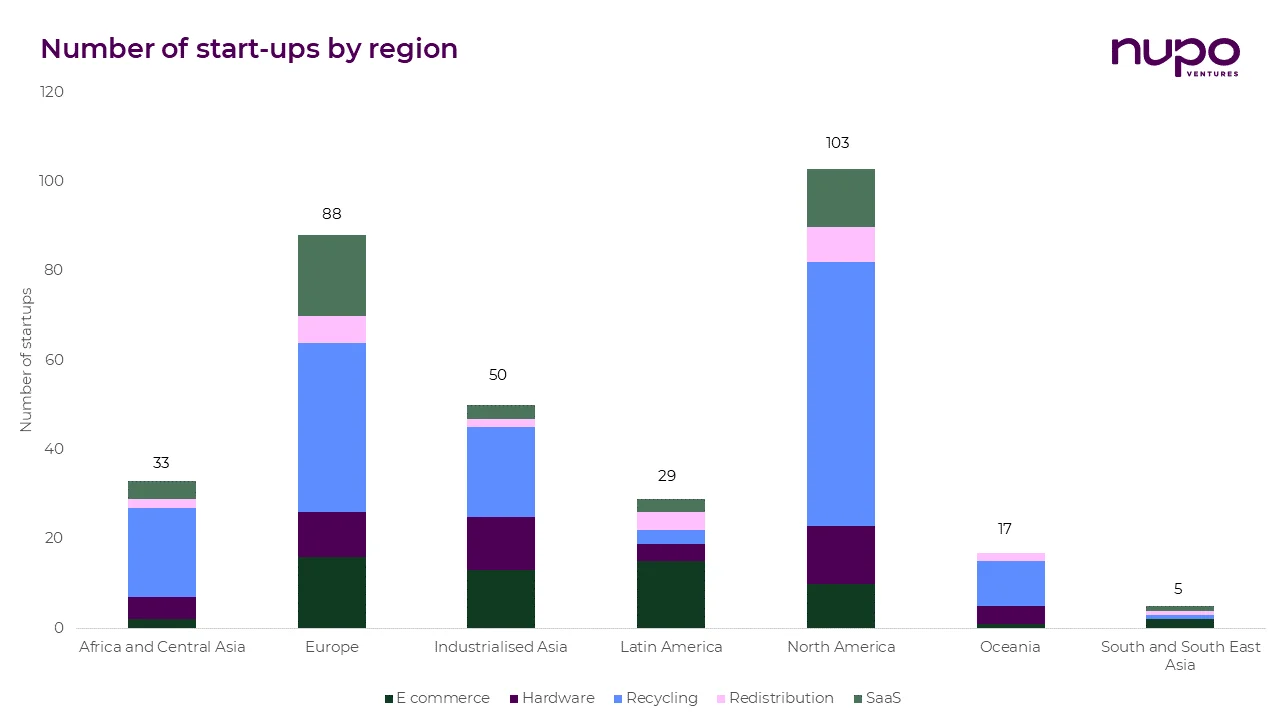

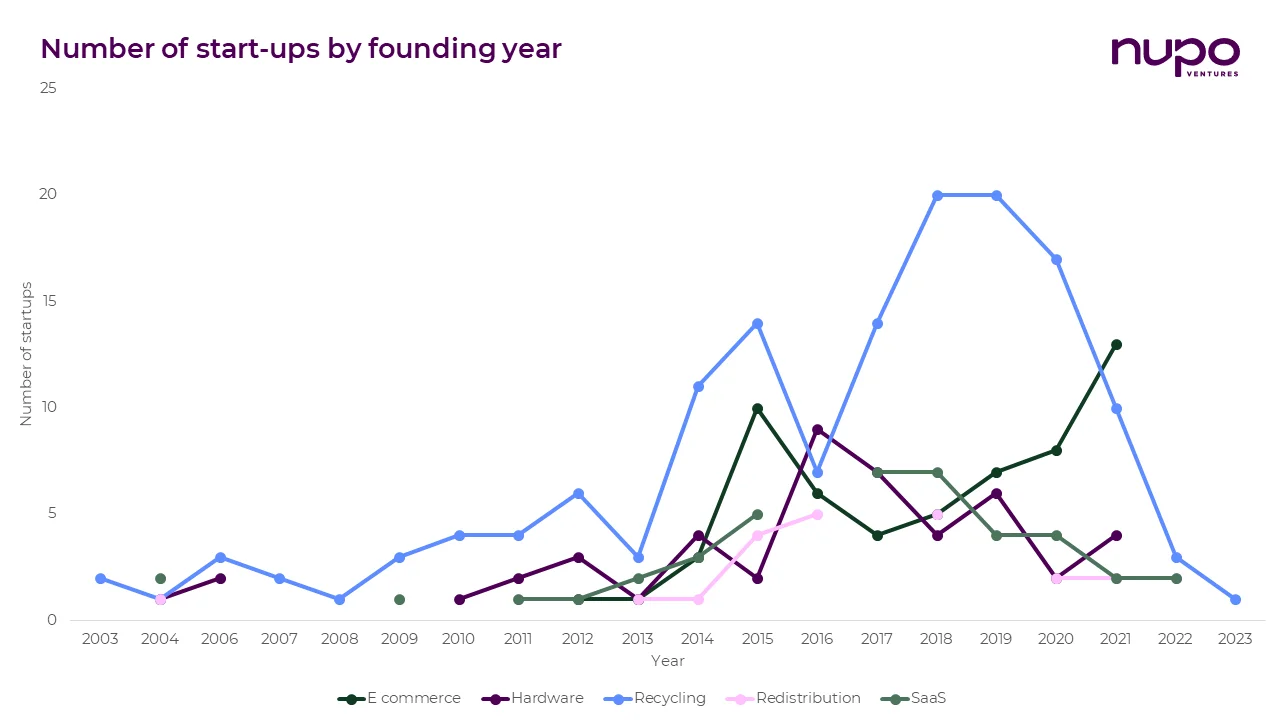

Key players in this endeavor are businesses, particularly innovative startups that are reimagining how the food supply chain operates and provide solutions to food waste. Our comprehensive analysis, of over 300 such startups, sheds light on their contributions and strategies. This article will delve into the key findings and insights from our study, offering a deeper understanding of the emerging trends in combating food waste.

Handling it versus preventing it

In food waste management, startups are split between two key strategies: handling existing waste and preventing waste from occurring. About 32% of startups focus on the former, developing efficient, sustainable methods for disposing of, repurposing, and managing food waste. Their goal is to reduce food waste's environmental impact and its accumulation in landfills.

Conversely, 68% of the startups are engaged in prevention, aiming to stop food waste before it happens. This proactive strategy involves a series of interventions across the food supply chain, from production to consumer behavior. These startups are innovating in areas like supply chain management, inventory optimization technologies, consumer education on how to reduce food waste, and sustainable practices in food production and packaging. The emphasis on prevention highlights the broader understanding of the multi-dimensional benefits — economic, social, and environmental — of tackling food waste at its source.

Business model innovations

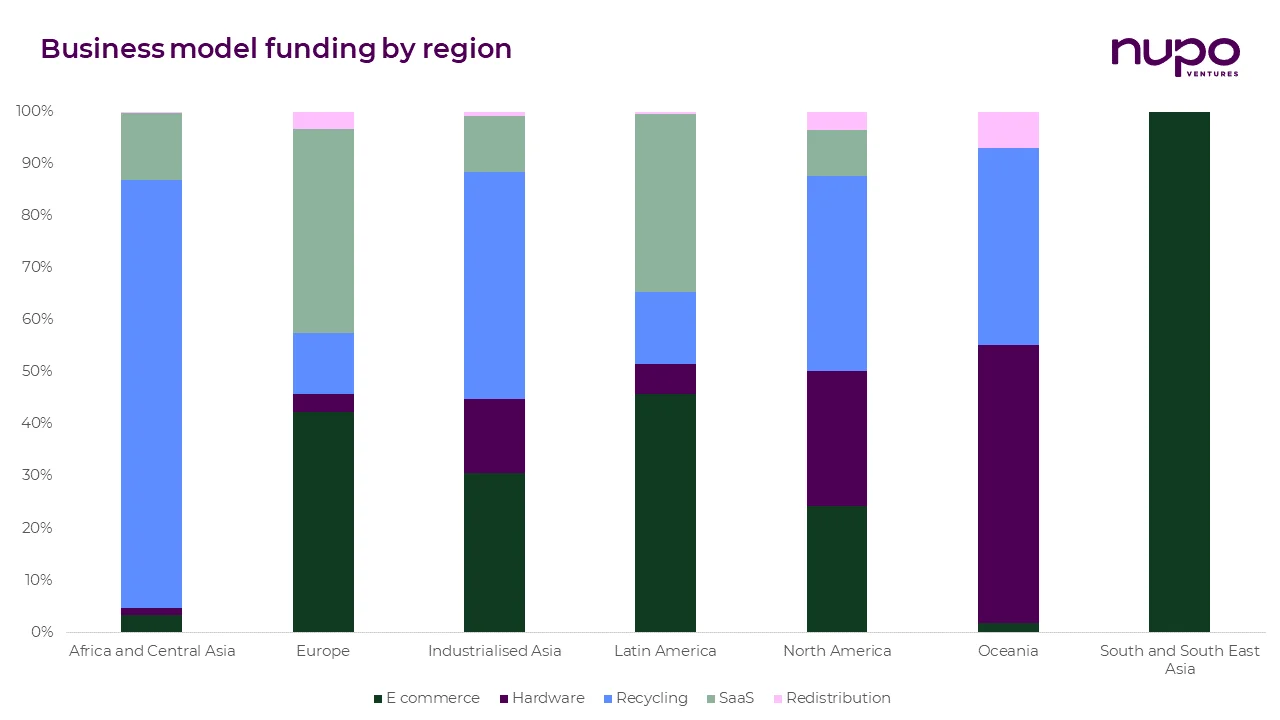

In our analysis of startups tackling food waste, we identified five main categories of business models based on their core functions.